The Ultimate Guide to Forex Trading Apps Maximize Your Trading Potential 1827035844

The Ultimate Guide to Forex Trading Apps

In today’s fast-paced financial market, having access to real-time information and trading tools is crucial for any Forex trader. Thanks to technology, Forex trading apps allow traders to engage with the market anytime and anywhere. Whether you are a seasoned trader or just starting, using a Forex trading app can significantly enhance your trading experience. In this comprehensive guide, we will explore the functionalities, benefits, and top Forex trading apps available today. If you’re looking for a reliable resource for Forex trading, visit forex trading app https://brokerdirect.org/.

Why Use a Forex Trading App?

Forex trading apps have revolutionized the trading landscape. Here are some of the key reasons why they are essential:

- Accessibility: Traders can access their accounts and make trades on the go, provided they have an internet connection.

- Real-time Data: Stay updated with live market data, allowing for quick reaction times to market changes.

- User-Friendly Interface: Most Forex trading apps are designed with a focus on user experience, making it easy even for novice traders.

- Advanced Tools: Traders can use different technical analysis tools, indicators, and charting features which can aid in making informed trading decisions.

Features of an Ideal Forex Trading App

When selecting a Forex trading app, certain features should be considered to ensure it meets your trading needs:

- Real-Time Forex Quotes: The app should provide live market quotes to make timely trading decisions.

- Trading Tools: Look for features such as one-click trading, stop-loss orders, and take-profit functionality.

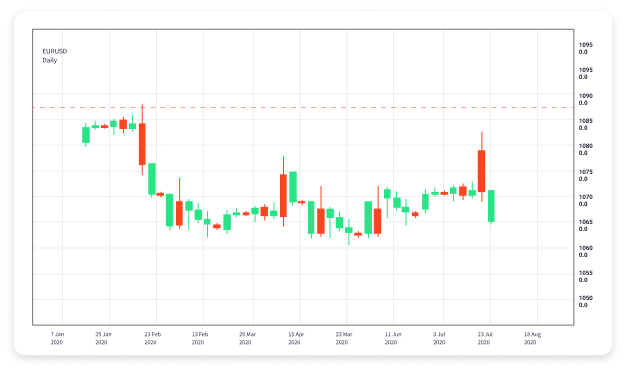

- Charting and Analysis: Comprehensive charting tools and technical indicators to analyze market trends effectively.

- Mobile Compatibility: Ensure the app works smoothly on different mobile devices and operating systems.

- Customer Support: Reliable customer service can help resolve any issues promptly.

Top Forex Trading Apps in 2023

Here is a selection of some of the top Forex trading apps as we move into 2023:

1. MetaTrader 4 (MT4)

MetaTrader 4 remains one of the most popular trading platforms. It offers a range of analytical tools, automated trading with Expert Advisors, and a user-friendly interface. The app supports various trading instruments, making it a versatile choice for Forex traders.

2. MetaTrader 5 (MT5)

MetaTrader 5 is the successor to MT4, boasting additional features, including more timeframes, enhanced charting tools, and the ability to trade stocks and commodities in addition to Forex, providing a more comprehensive trading experience.

3. TradingView

While primarily known for its advanced charting capabilities, TradingView also allows Forex trading through brokers that integrate with the platform. The community-driven environment provides traders access to various ideas, strategies, and analyses from users worldwide.

4. eToro

eToro is unique for its social trading features, where traders can copy the trades of successful investors. The app is user-friendly and ideal for those who want to blend social networking with Forex trading.

5. OANDA

OANDA’s app provides robust trading tools with real-time currency data, advanced charting, and customizable trading features. It’s particularly known for its reliability and comprehensive trading analytics.

Common Mistakes to Avoid with Forex Trading Apps

Even with the best tools at your disposal, mistakes can still occur. Here are common pitfalls to avoid:

- Ignoring Risk Management: Always use stop-loss orders and limit your exposure to any single trade.

- Neglecting Market Research: Don’t skip analyzing market trends and economic factors just because an app provides signals.

- Overtrading: Trading too frequently can lead to unnecessary losses. Stick to your trading plan and avoid the impulse to make quick profits.

Conclusion

Forex trading apps have made it easier than ever for traders to access the global currency market. By choosing the right app and utilizing its features effectively, you can enhance your trading experience, make informed decisions, and maximize your potential profits. Remember to stay updated with the latest changes in the Forex market and continuously educate yourself to become a successful trader. With the right tools, your trading journey can be rewarding and enjoyable.